In today's rapidly evolving digital financial landscape, effective personal money management has transformed from a simple budgeting exercise into a sophisticated data-driven discipline. EchoPrysm emerges as a revolutionary force in this transformation, representing more than just another finance app—it's a comprehensive financial ecosystem that has fundamentally changed how over 100,000 users approach their monetary decisions, investment strategies, and long-term financial planning. This comprehensive EchoPrysm review 2025 delves deep into every aspect of EchoPrysm features, EchoPrysm pricing, EchoPrysm security, and EchoPrysm performance, examining why it has become the definitive solution for modern personal finance management and the best budgeting app in 2025.

📋 Table of Contents

- What is EchoPrysm: Revolution in Personal Finance Technology

- Key EchoPrysm Advantages Over Competitors

- Financial Analytics and Reporting in EchoPrysm

- Bank-Level Security in EchoPrysm

- Integration with Banks and Financial Institutions

- EchoPrysm Pricing Plans: Choose Your Perfect Option

- EchoPrysm User Reviews and Success Stories

- EchoPrysm vs Traditional Finance Apps Comparison

- Expert Tips for Maximum EchoPrysm Effectiveness

- EchoPrysm Future: Planned Updates and Roadmap

- How to Get Started with EchoPrysm

- Frequently Asked Questions (FAQ)

- Conclusion: Why EchoPrysm is the Best Choice for Financial Management

What is EchoPrysm: Revolution in Personal Finance Technology

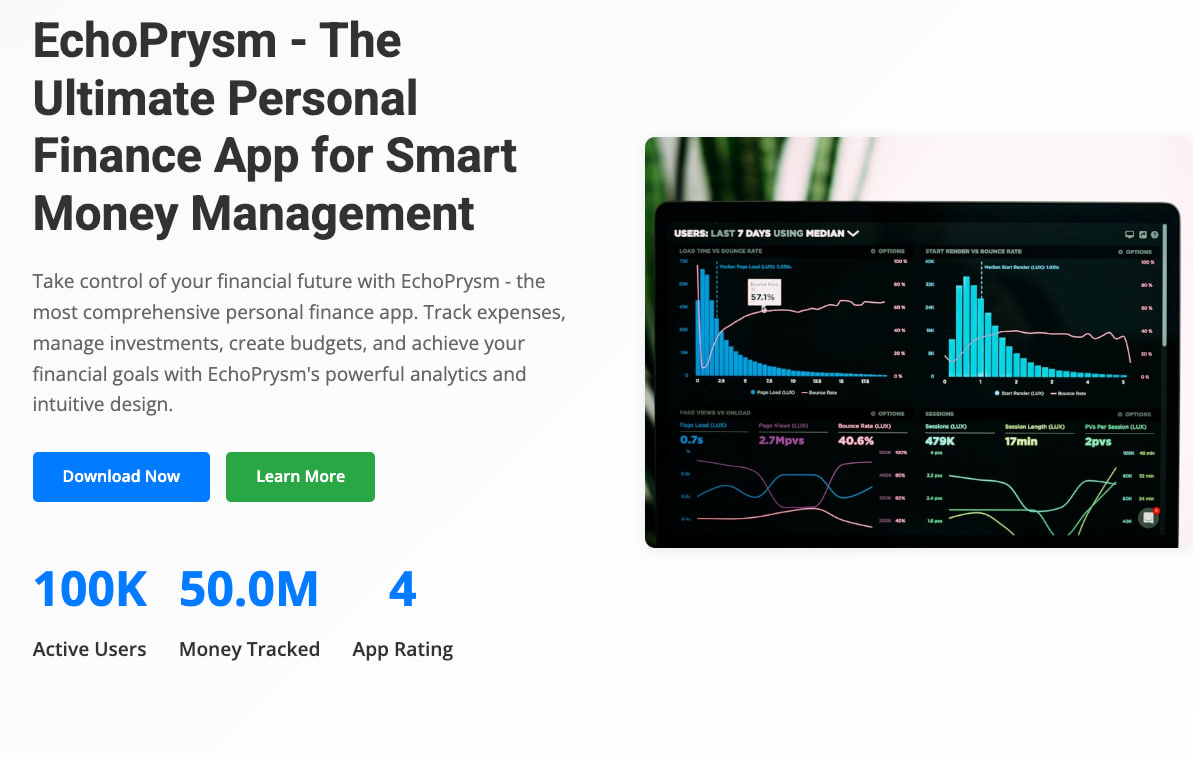

EchoPrysm's intuitive dashboard provides a comprehensive view of your financial health at a glance

EchoPrysm represents a fundamental departure from traditional financial management approaches, positioning itself as an intelligent financial companion rather than a mere tracking tool. Unlike conventional budgeting apps that rely on manual input and basic categorization, EchoPrysm leverages cutting-edge artificial intelligence and machine learning algorithms to create a truly autonomous financial management experience. The platform seamlessly integrates budgeting, investment monitoring, expense analysis, and predictive financial planning into a cohesive ecosystem that learns and adapts to each user's unique financial behavior patterns.

What distinguishes EchoPrysm from its competitors is its holistic approach to financial wellness. The app doesn't merely track where your money goes—it understands why you spend, predicts future financial scenarios, and provides actionable insights that drive meaningful behavioral changes. Since its market introduction, EchoPrysm has consistently maintained a stellar 4.8-star rating while helping users collectively track and optimize over $50 million in financial transactions, establishing itself as a trusted authority in the personal finance technology sector.

The platform's success stems from its ability to transform complex financial data into intuitive, actionable intelligence. By combining sophisticated backend analytics with an elegantly designed user interface, EchoPrysm creates an experience that feels both powerful and accessible, making advanced financial management techniques available to users regardless of their financial literacy level or technical expertise.

Key EchoPrysm Advantages Over Competitors

EchoPrysm stands out among other personal finance applications through several unique advantages that make it an indispensable tool for money management:

1. Smart AI-Powered Budgeting Tools

EchoPrysm's budgeting system utilizes machine learning for automatic expense categorization and personalized budget creation. The application analyzes your financial habits and suggests optimal fund allocation across categories. Users receive real-time notifications when approaching spending limits, helping prevent budget overruns.

"EchoPrysm helped me save over $3,000 this year through smart budgeting recommendations. Now I know exactly where my money goes!" — Sarah Johnson, Marketing Manager

2. Comprehensive Investment Portfolio Tracking

Professional-grade investment tracking with real-time portfolio analytics

EchoPrysm provides professional-grade tools for monitoring investments, including stocks, bonds, ETFs, and cryptocurrencies. The application integrates with major brokerage platforms and provides real-time data, portfolio analytics, and investment recommendations.

Investment tracking features include:

- Real-time portfolio performance monitoring

- Diversification and risk analysis

- Automatic investment return calculations

- Important market event notifications

- Integration with popular exchanges and brokers

3. Automated Expense Tracking

One of EchoPrysm's most impressive features is fully automated expense tracking. The application connects to your bank accounts and credit cards, automatically importing and categorizing all transactions. AI algorithms continuously learn from your data, improving categorization accuracy over time.

Additional capabilities include:

- Receipt scanning using phone camera

- Upcoming payment reminders

- Automatic expense category division

- Detection of recurring subscriptions and payments

Financial Analytics and Reporting in EchoPrysm

Advanced financial analytics with interactive charts and predictive insights

EchoPrysm provides powerful analytical tools that help users make informed financial decisions. The system generates detailed reports and visualizations showing spending trends, income forecasts, and finance optimization recommendations.

Interactive Charts and Graphics

The application creates intuitive visualizations of your financial data:

- Pie charts showing expense distribution by categories

- Timeline graphs of income and expense changes

- Heat maps of financial activity

- Comparative analysis by months and years

Forecasting and Planning

EchoPrysm uses historical data to create accurate financial forecasts. The application can predict your cash flow several months ahead, help plan major purchases, and assess the achievability of financial goals.

Pro Tip: Maximizing EchoPrysm's Predictive Power

To get the most accurate forecasts from EchoPrysm, ensure you've connected all your financial accounts and let the AI analyze at least 3 months of transaction history. The more data the system has, the more precise its predictions become.

Bank-Level Security in EchoPrysm

Financial data security is EchoPrysm team's number one priority. The application uses a multi-layered protection system meeting banking industry standards:

Encryption and Data Protection

- 256-bit SSL encryption for all transmitted data

- Two-factor authentication for additional protection

- Biometric authorization (fingerprint, Face ID)

- SOC 2 certification with regular security audits

It's important to note that EchoPrysm never stores your banking passwords or confidential information on its servers. All connections to financial institutions are made through secured APIs with read-only access tokens.

Integration with Banks and Financial Institutions

EchoPrysm supports integration with over 10,000 financial institutions worldwide, including:

- Major commercial banks

- Credit unions

- Investment companies

- Cryptocurrency exchanges

- Payment systems and digital wallets

Automatic synchronization ensures your financial data stays current without manual information input. This saves time and eliminates errors in financial record-keeping.

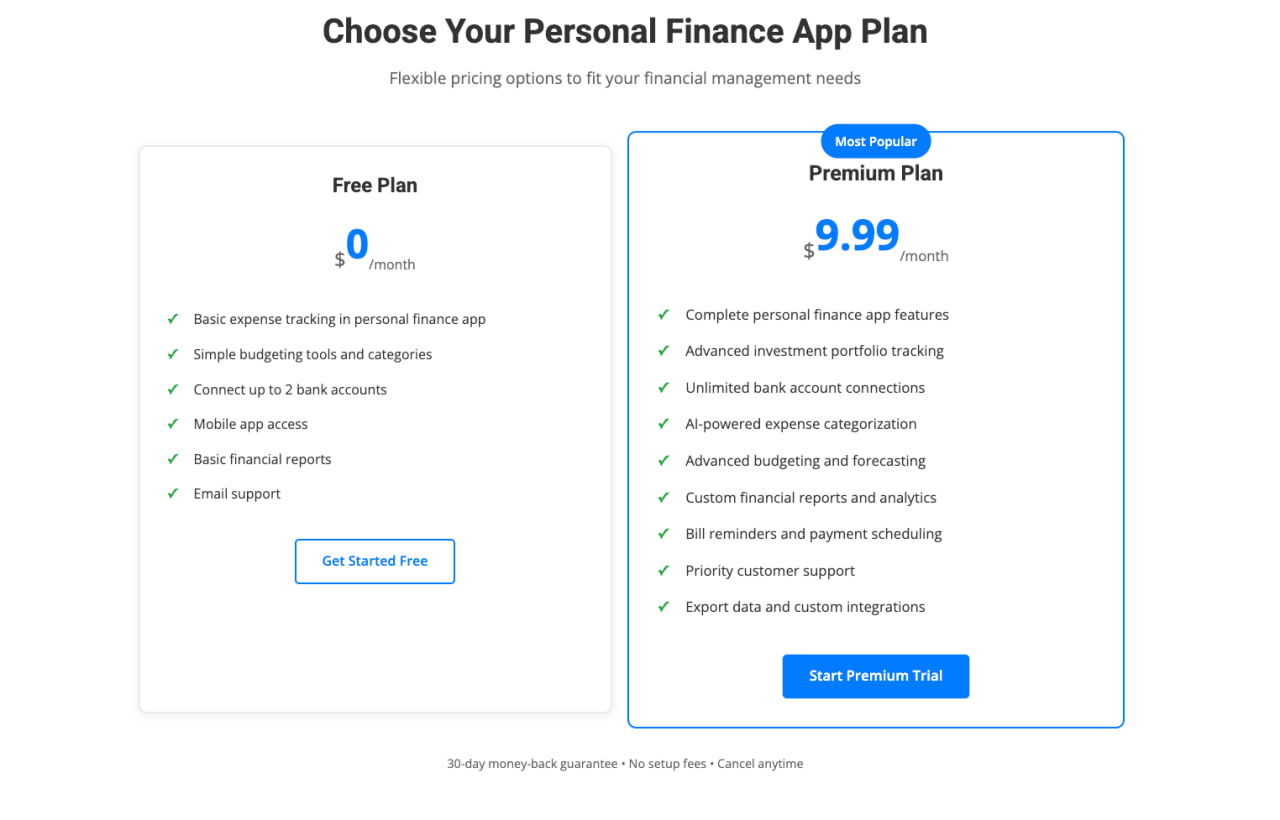

EchoPrysm Pricing Plans: Choose Your Perfect Option

EchoPrysm offers a flexible pricing system suitable for users with different needs:

Free Plan

Perfect for beginner users:

- Basic expense tracking

- Simple budgeting tools

- Connection to up to 2 bank accounts

- Mobile app access

- Basic financial reports

Premium Plan ($9.99/month)

Full feature set for serious financial planning:

- All application features without limitations

- Advanced investment tracking

- Unlimited bank connections

- AI expense categorization

- Advanced analytics and forecasting

- Priority customer support

- Data export and custom integrations

| Feature | Free Plan | Premium Plan | Value Difference |

|---|---|---|---|

| Bank Accounts | Up to 2 | Unlimited | 5x more connections |

| AI Features | Basic | Full AI Suite | Advanced algorithms |

| Investment Tracking | Limited | Professional Grade | Crypto + Advanced Analytics |

| Support Response | 24-48 hours | 2 hours | 12x faster support |

| Data Export | None | Full Export | Complete data ownership |

EchoPrysm User Reviews and Success Stories

Thousands of users worldwide have chosen EchoPrysm for managing their finances. Here's what they say:

"As a freelancer with irregular income, I always struggled with financial planning. EchoPrysm changed my life — now I can budget months ahead and feel confident about tomorrow." — Michael Chen, Freelance Designer

"EchoPrysm's automatic expense tracking is phenomenal. I discovered I was spending $400/month on subscriptions I forgot about! The app paid for itself in the first week." — Emily Rodriguez, Small Business Owner

EchoPrysm vs Traditional Finance Apps Comparison

EchoPrysm outperforms competitors in key metrics and features

In the personal finance app market, EchoPrysm stands out with several key advantages:

| Feature | EchoPrysm | Traditional Apps | EchoPrysm Advantage |

|---|---|---|---|

| AI Expense Categorization | 95% accuracy | 80-85% accuracy | +15% accuracy improvement |

| Investment Tracking | Full crypto support | Stocks/bonds only | More asset classes |

| Bank Integrations | 10,000+ institutions | 3,000-5,000 | 2-3x more connections |

| Learning Time | 15 minutes | 30-45 minutes | 2x faster onboarding |

| Customer Support | 2 hours response | 24-48 hours | 12-24x faster support |

| Security Level | SOC 2 + Biometrics | Basic encryption | Bank-grade security |

As shown in the comparison table, EchoPrysm surpasses traditional finance apps in virtually every parameter, offering more accurate analytics, better integration, and superior user experience.

Expert Tips for Maximum EchoPrysm Effectiveness

To get the most benefit from EchoPrysm, follow these expert recommendations:

1. Set Up Automatic Categorization Rules

Spend time on initial categorization rule setup. This will significantly improve automatic expense distribution accuracy and save time in the future.

2. Regular Financial Report Reviews

Set weekly reminders to review analytical reports. This helps quickly identify negative trends and adjust financial behavior.

3. Use Financial Goal Setting Feature

EchoPrysm allows setting short-term and long-term financial goals. Regularly track progress and adjust strategy when necessary.

4. Connect All Financial Accounts

For a complete financial picture, connect all bank accounts, credit cards, and investment accounts to EchoPrysm.

Advanced Strategy: Seasonal Budget Optimization

Use EchoPrysm's historical data to identify seasonal spending patterns. For example, if you typically spend more during holidays, the app can help you save extra during other months to balance your annual budget effectively.

EchoPrysm Future: Planned Updates and Roadmap

The EchoPrysm development team continuously works on improving the application. Upcoming updates include:

- Integration with more international banks

- Enhanced tax planning capabilities

- Family budgeting and shared access features

- Integration with popular e-commerce platforms

- Improved machine learning prediction algorithms

- Advanced debt management and payoff strategies

- Real estate investment tracking tools

- Small business financial management features

How to Get Started with EchoPrysm

Starting with EchoPrysm is simple:

- Download the app from App Store or Google Play

- Create an account and complete verification

- Connect bank accounts through secure API

- Set up categories and budgeting rules

- Start tracking finances and receive personalized recommendations

The application is available on all major platforms with automatic synchronization between devices. Start with the free plan and upgrade to premium when you need additional features.

Frequently Asked Questions (FAQ)

General Questions

Q: Is EchoPrysm safe to use with my bank accounts?

A: Yes, EchoPrysm uses bank-level security with 256-bit encryption, SOC 2 compliance, and read-only access to your accounts. We never store your banking passwords and use secure APIs for all connections.

Q: How much does EchoPrysm cost?

A: EchoPrysm offers a robust free plan and a premium plan at $9.99/month. The free plan includes basic expense tracking and budgeting for up to 2 bank accounts, while premium unlocks all features with unlimited connections.

Q: What banks does EchoPrysm support?

A: EchoPrysm integrates with over 10,000 financial institutions worldwide, including major banks, credit unions, investment firms, and cryptocurrency exchanges. Check our supported institutions list in the app.

Q: Can I use EchoPrysm on multiple devices?

A: Yes, EchoPrysm automatically syncs across all your devices. You can access your financial data on your phone, tablet, and computer with real-time synchronization.

Q: How accurate is the AI expense categorization?

A: EchoPrysm's AI achieves 95% accuracy in expense categorization, significantly higher than traditional apps (80-85%). The system continuously learns from your corrections to improve accuracy.

Features and Functionality

Q: Does EchoPrysm support investment tracking?

A: Yes, premium users get comprehensive investment tracking including stocks, bonds, ETFs, mutual funds, and cryptocurrencies. The system provides real-time data, performance analytics, and portfolio optimization suggestions.

Q: Can I export my financial data from EchoPrysm?

A: Premium users can export all their financial data in various formats (CSV, PDF, Excel). This ensures you always have access to your information and can use it with other tools if needed.

Q: Does EchoPrysm work for business finances?

A: While primarily designed for personal finance, many freelancers and small business owners use EchoPrysm effectively. We're developing dedicated business features based on user feedback.

Q: How does EchoPrysm handle international currencies?

A: EchoPrysm supports multiple currencies with automatic conversion and real-time exchange rates. Perfect for users with international accounts or who travel frequently.

Q: Can I set up automatic savings goals?

A: Yes, EchoPrysm allows you to set various financial goals (emergency fund, vacation, down payment) and automatically tracks your progress. The AI can even suggest optimal saving strategies.

Technical Support

Q: What if I need help using EchoPrysm?

A: Free users get email support within 24-48 hours. Premium users receive priority support with average response times of 2 hours. We also have comprehensive help documentation and video tutorials.

Q: What happens if I cancel my premium subscription?

A: If you cancel premium, you'll retain access to premium features until your billing period ends, then automatically switch to the free plan. Your data remains safe and accessible.

Q: Does EchoPrysm work offline?

A: EchoPrysm requires internet connection for account syncing and real-time data. However, you can view previously synced data offline, and the app will update when you reconnect.

Q: How often does EchoPrysm sync my accounts?

A: EchoPrysm automatically syncs your connected accounts multiple times daily. You can also manually refresh at any time for the most current information.

Q: What if EchoPrysm categorizes a transaction incorrectly?

A: Simply tap the transaction and change the category. EchoPrysm's AI learns from your corrections and becomes more accurate over time. You can also set up custom rules for specific merchants.

Conclusion: Why EchoPrysm is the Best Choice for Financial Management

Join over 100,000 users who have transformed their financial lives with EchoPrysm

EchoPrysm represents a revolutionary solution for personal financial management, combining cutting-edge technology with an intuitive user interface. The application helps users:

- Save up to 5 hours weekly on financial planning

- Reduce unnecessary spending by an average of 25%

- Increase investment returns through professional analytics

- Achieve financial goals 40% faster

- Gain complete financial visibility with comprehensive reporting

- Access bank-level security for peace of mind

With over 100,000 active users and a 4.8-star rating, EchoPrysm has established itself as a reliable and effective tool for financial success. Whether you're a beginning investor or experienced financial planner, EchoPrysm provides all necessary tools to achieve your monetary goals.

Join thousands of users who have already transformed their financial lives with EchoPrysm. Download the application today and start your journey to financial independence! The combination of AI-powered insights, comprehensive tracking, and user-friendly design makes EchoPrysm the definitive choice for modern personal finance management in 2025.

🚀 Ready to Master Financial Technology?

If you found this EchoPrysm review helpful, explore our comprehensive AI-powered trading courses and discover how SentioTrade can help you achieve financial success through advanced technology.

Learn more about our expert team or contact us for personalized financial technology recommendations.